All Categories

Featured

Table of Contents

The inquirer represents a client that was a complainant in an accident matter that the inquirer picked behalf of this plaintiff. The defendants insurer agreed to pay the complainant $500,000 in a structured negotiation that requires it to purchase an annuity on which the complainant will be listed as the payee.

The life insurance coverage company providing the annuity is a licensed life insurance coverage firm in New York State. N.Y. Ins.

N.Y. Ins.

annuity agreements,. released to a citizen by a life insurance policy company licensed to negotiate life or medical insurance or annuities in this state at the time the policy, contract or arrangement was released." N.Y. Ins. Law 7704 (McKinney 2002) states in the relevant component that" [t] his post will be liberally understood to effect the objective under section 7 thousand 7 hundred 2 of this short article.

" The Department has actually reasoned that an annuitant is the holder of the basic right provided under an annuity agreement and mentioned that ". [i] t is that right which is most qualified to security in case of the problems or bankruptcy of the insurance company." NY General Advise Point Of View 5-1-96; NY General Guidance Viewpoint 6-2-95.

Nyl Annuities Login

The owner of the annuity is a Massachusetts corporation, the intended beneficiary and payee is a resident of New York State. Since the above stated purpose of Article 77, which is to be freely taken, is to protect payees of annuity agreements, the payee would be secured by The Life Insurance Policy Company Guaranty Firm of New York.

* A prompt annuity will not have a buildup stage. Variable annuities provided by Safety Life Insurance Coverage Business (PLICO) Nashville, TN, in all states other than New York and in New York by Protective Life & Annuity Insurance Coverage Business (PLAIC), Birmingham, AL.

What Is Annuity Rates

Capitalists should meticulously consider the financial investment objectives, risks, fees and costs of a variable annuity and the underlying financial investment options prior to spending. An indexed annuity is not a financial investment in an index, is not a safety or supply market investment and does not participate in any type of supply or equity investments.

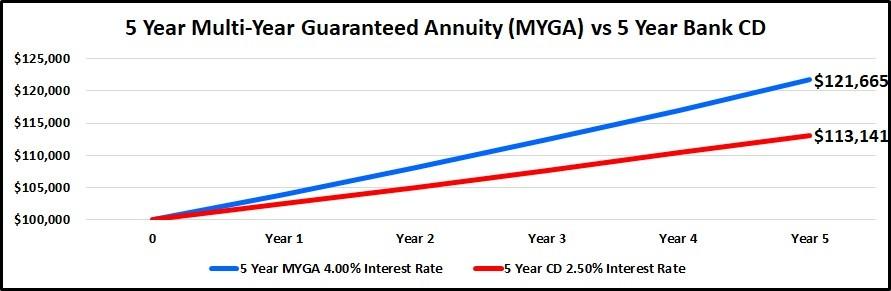

The term can be three years, five years, 10 years or any number of years in between. A MYGA works by locking up a round figure of money to allow it to build up interest. If you need to take out cash from an annuity before the build-up period mores than, you might have to pay charges called surrender charges.

Immediate Annuity Quote

If you choose to renew the contract, the rates of interest might vary from the one you had actually originally consented to. One more alternative is to transfer the funds right into a different sort of annuity. You can do so without encountering a tax obligation fine by utilizing a 1035 exchange. Since interest prices are established by insurer that offer annuities, it is very important to do your study before signing a contract.

They can defer their taxes while still used and not seeking additional taxable earnings. Given the present high rate of interest, MYGA has actually come to be a significant part of retired life financial planning - annuity estimates. With the probability of rates of interest reductions, the fixed-rate nature of MYGA for a set number of years is extremely interesting my clients

MYGA prices are normally higher than CD rates, and they are tax obligation deferred which additionally boosts their return. A contract with more restricting withdrawal stipulations may have greater prices.

In my viewpoint, Claims Paying Ability of the carrier is where you base it. You can look at the state warranty fund if you want to, yet keep in mind, the annuity mafia is watching.

They understand that when they place their money in an annuity of any type of type, the company is going to back up the case, and the industry is overseeing that. Are annuities guaranteed? Yeah, they are. In my point of view, they're risk-free, and you need to go right into them considering each carrier with self-confidence.

If I placed a referral in front of you, I'm additionally placing my certificate on the line as well - annuity cd. Remember that. I'm very certain when I put something in front of you when we speak on the phone. That does not imply you need to take it. You might state, "Yes, Stan, you said to buy this A-rated firm, however I really feel better with A dual and also." Penalty.

Best Lifetime Annuities

We have the Claims Paying Capability of the carrier, the state guaranty fund, and my friends, that are unknown, that are circling around with the annuity mafia. That's a factual answer of somebody who's been doing it for a really, really lengthy time, and who is that a person? Stan The Annuity Male.

Individuals typically purchase annuities to have a retirement earnings or to develop cost savings for an additional objective. You can purchase an annuity from a qualified life insurance policy agent, insurer, financial planner, or broker. You need to speak with a monetary consultant about your requirements and objectives prior to you buy an annuity.

Variable Annuities Definition

The difference in between both is when annuity settlements start. enable you to conserve cash for retired life or other reasons. You do not need to pay tax obligations on your revenues, or contributions if your annuity is an individual retired life account (IRA), until you take out the profits. enable you to create an income stream.

Deferred and prompt annuities use a number of alternatives you can choose from. The choices supply different levels of potential risk and return: are ensured to gain a minimum rate of interest price.

Variable annuities are higher risk due to the fact that there's a chance you could lose some or all of your cash. Set annuities aren't as risky as variable annuities because the financial investment danger is with the insurance business, not you.

What Is An Annuity Plan

If performance is low, the insurance coverage company bears the loss. Set annuities ensure a minimum rate of interest price, normally between 1% and 3%. The company may pay a greater rates of interest than the ensured rate of interest. The insurance provider establishes the rates of interest, which can transform regular monthly, quarterly, semiannually, or every year.

Index-linked annuities reveal gains or losses based upon returns in indexes. Index-linked annuities are a lot more intricate than taken care of deferred annuities. It is very important that you understand the functions of the annuity you're taking into consideration and what they suggest. The 2 contractual features that influence the amount of interest credited to an index-linked annuity one of the most are the indexing approach and the engagement rate.

Each depends on the index term, which is when the company calculates the interest and debts it to your annuity. The identifies just how much of the increase in the index will certainly be made use of to compute the index-linked passion. Various other vital attributes of indexed annuities consist of: Some annuities top the index-linked rate of interest.

Not all annuities have a flooring. All taken care of annuities have a minimum surefire value.

Other annuities pay substance passion throughout a term. Substance rate of interest is interest gained on the money you conserved and the rate of interest you make.

Highest Yielding Annuities

If you take out all your cash before the end of the term, some annuities won't attribute the index-linked interest. Some annuities may attribute just component of the rate of interest.

This is since you birth the financial investment risk instead of the insurance firm. Your representative or economic adviser can assist you determine whether a variable annuity is best for you. The Securities and Exchange Payment identifies variable annuities as safeties due to the fact that the efficiency is acquired from supplies, bonds, and other investments.

Current Annuity Rate

An annuity contract has 2 stages: a buildup stage and a payout stage. You have numerous alternatives on just how you add to an annuity, depending on the annuity you purchase: allow you to select the time and amount of the repayment.

enable you to make the very same settlement at the very same period, either monthly, quarterly, or each year. The Internal Profits Service (INTERNAL REVENUE SERVICE) controls the tax of annuities. The internal revenue service allows you to postpone the tax obligation on earnings up until you withdraw them. If you withdraw your profits before age 59, you will probably need to pay a 10% early withdrawal fine in addition to the taxes you owe on the passion made.

After the buildup phase finishes, an annuity enters its payout stage. This is in some cases called the annuitization stage. There are a number of options for obtaining payments from your annuity: Your company pays you a repaired amount for the time stated in the contract. The business pays to you for as long as you live, however there are none settlements to your heirs after you die.

Numerous annuities charge a charge if you take out cash prior to the payment stage. This charge, called a surrender cost, is commonly greatest in the very early years of the annuity. The cost is typically a portion of the taken out money, and normally starts at about 10% and drops annually up until the abandonment duration mores than.

Table of Contents

Latest Posts

Breaking Down Your Investment Choices A Closer Look at Fixed Vs Variable Annuities What Is the Best Retirement Option? Benefits of Fixed Annuity Vs Variable Annuity Why Annuities Fixed Vs Variable Is

Understanding Financial Strategies A Closer Look at How Retirement Planning Works What Is Fixed Indexed Annuity Vs Market-variable Annuity? Benefits of Fixed Annuity Vs Equity-linked Variable Annuity

Highlighting the Key Features of Long-Term Investments Key Insights on Fixed Income Annuity Vs Variable Annuity What Is Retirement Income Fixed Vs Variable Annuity? Benefits of Choosing the Right Fina

More

Latest Posts